In the first part of this series attempting to sum up the issues facing UK science and innovation policy, I attempted to set the context by laying out the wider challenges the UK government faces, asking what problems we need our science and innovation system to contribute to solving. In this second part, I move on to some big questions about how the UK’s science and innovation system works.

2. Some overarching issues

2.1. How research intensive should the UK economy be?

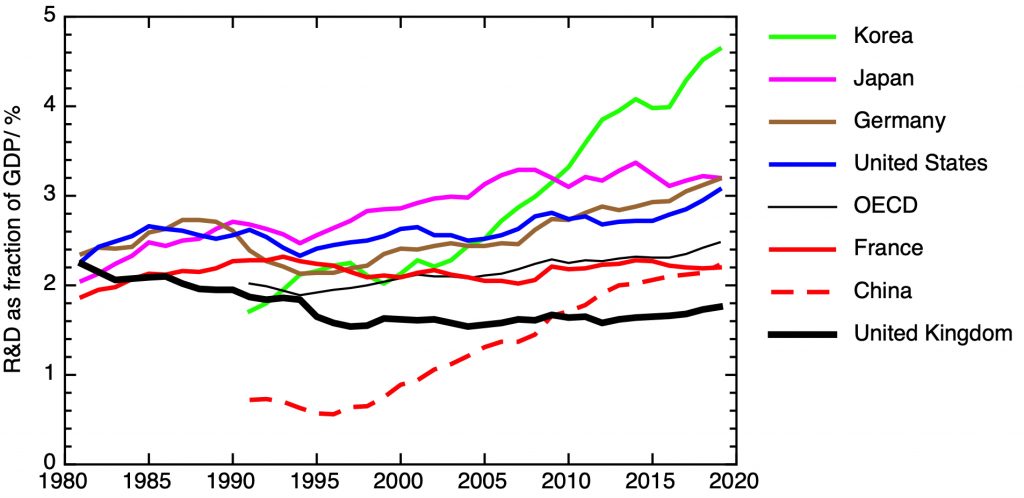

Total R&D intensity of selected countries, and OECD average (General expenditure on R&D as fraction of GDP). OECD Main Science and Technology Indicators.

The research intensity of the UK’s economy currently is low, both by the standards of other comparable countries, and by comparison to its position at the beginning of the 1980’s as one of the world’s most R&D intensive economies. In 2019, the UK’s R&D intensity – as measured by the fraction of total GDP spent on R&D, both public and private – stood at a little less than 1.8%; this compared with an OECD average of nearly 2.5%. The government has a stated policy of increasing R&D intensity to 2.4% of GDP by 2027, while the Labour opposition campaigned for a more ambitious goal, of 3% by 2030. So there is consensus on the need to increase R&D intensity. But why the focus on a single number, and how should one choose such a target?

The reason 2.4% was chosen was because it corresponded to the OECD average (which itself, as the plot makes clear is itself slowly increasing, presenting a moving target). Measuring R&D as a fraction of GDP is simply a measure of the proportion of total economic effort devoted to the systematic development and application of new knowledge; economists currently think of it as being a subset of investment in intangible assets, itself part of the wider picture of investment in the capital stock.

The wider picture here is that the UK has a history of low investment of all kinds – over the 20 year period to 2017, the UK had the lowest level of private sector investment for any G7 nation, and the second lowest government investment.

So one way of interpreting the UK’s low R&D intensity is as part of a wider reluctance, both from the private sector and HM Treasury, to forgo consumption now in the hope of rewards in the future. In other words, there’s a kind of national failure to pass the marshmallow test. Of course, this isn’t a question of some national moral failing, if true it’s likely to reflect institutional factors.

R&D is carried out (and paid for) both by private sector firms and by the government and its agents – in economies like ours, there’s a rule of thumb that the private sector carries out about twice the value of R&D than the government. So we need to look for such institutional factors both in the private sector, for example in the demands placed on companies from the financial markets, as well as in the accounting conventions and wider assumptions used in government. I suspect that there are issues here, but the necessary institutional changes will be difficult and take time to have an effect

Another argument is that the low R&D intensity of the UK is an inevitable consequence of the sectoral make-up of its economy, reflecting the transition from R&D-heavy manufacturing to the less research-intensive world of services. In such an economy, intangible assets are central. Although R&D itself produces such intangible assets, in the form of patents and know-how, there are other forms of intangibles. Defining intellectual property products (IPP) slightly more broadly than patents and R&D, to include, for example, entertainment products such as film, TV or radio, one finds that among G7 nations, UK invests more in IPP than Italy and Canada, less than USA, Japan and France, and (interestingly) about the same as Germany.

We should be careful, though, not to think of “services” as a single sector. The parts referred to as “knowledge intensive business services” – including design, technical consultancy and professional services – are a significant area of comparative advantage for the UK, and they do undertake a significant amount of R&D. Other kinds of service industry – such as social care – measure relatively low in terms of apparent economic value, but are of vital social importance. More attention should be given to innovation in areas like these. Ultimately, though, what matters isn’t whether a sector can be classified as manufacturing or services, but whether it can deliver productivity growth.

Although there is a case to be made that, even given the UK economy’s existing sectoral structure, R&D spending is too low, it probably is true that targeting an increase of R&D intensity to 2.4% (or higher) does represent an implicit commitment to reshape the economy’s sectoral structure.

An R&D target should be thought of not as an end in itself, but as a means to an end. We should start by asking what kind of economy do we need, if we are to meet the big strategic goals that I discussed in the first part of this series. Given a clearer view about that, we’ll have a better understanding the necessary fraction of national resources that we should devote to research and development. I don’t know if that would produce the exact figure of 2.4%, but I wouldn’t be surprised if an appropriate target would be significantly higher.

2.2. The UK – good at research, no good at innovation?

There’s a long tradition – amounting to cliché – of arguing that the UK is very good at basic research, but systematically fails to commercialise it. I’m sceptical of the rather mystical cultural explanations sometimes advanced for this; I think the reason is more obvious – it’s because the UK doesn’t put in the resources that are needed to turn science into money. This isn’t a result of some trait in the national character; it’s the outcome of deliberate policy choices to de-emphasise the more applied R&D needed to convert ideas into products, in favour of more basic science.

Innovation is about matching new technical opportunities with unmet demands, and for that reason it needs to be done (at least strongly steered) by those agents who are in a position to recognise those unmet demands. In our economy, with the notable and important exceptions of the health service and the armed forces, that puts the emphasis on the private sector. Yet, as economists know well, the fact that firms aren’t able to capture all the benefits of the innovations they make means that, in the absence of some form of government intervention, the private sector will systematically underinvest in research and development.

This provides the justification for governments to support basic science, where the outcomes are highly uncertain and the benefits often only materialise in the long term. But there’s much less consensus about how much governments should be involved in supporting more applied research and development. In the UK, there has been a major, but underappreciated, change in the government’s position on this point.

As the historian of science Jon Agar wrote in his definitive study of science policy under Thatcher, there was a sharp shift in science policy in the late 1980’s: “there was a crystallisation of policy: government funding for near-market research was abruptly curtailed (because private industry should step up), and, to balance this, the science base, especially ‘curiosity-driven research’ was heralded.”

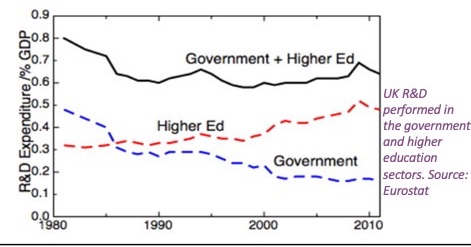

One can see this in the statistics: from the 1980’s onwards, there has been a major reduction in the R&D carried out by government departments and their agencies. The research done here was typically applied research in support of the direct goals of those agencies. From 2000 onwards, there was a significant increase in the R&D government supported in universities through the research councils, while departmental research continued to fall.

The period 1980 to 2010 saw a systematic shift of UK government supported R&D from government applied research to “curiosity driven” research in HE. From R.A.L. Jones, ‘The UK’s Innovation Deficit & How to Repair it’, SPERI paper number 6, 2013.

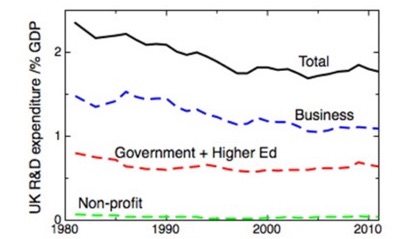

This provided an empirical test of the view of some free market evangelists, who argued that state spending on research “crowds out” research by the private sector. In fact, over the same period, instead of seeing private industry “stepping up” to fill the gap, there was a substantial decrease in business R&D intensity over the same period, supporting the current consensus view that state spending on R&D in fact tends to “crowd in” additional private sector R&D spending. It’s important to recognise that, at the same time, privatisation moved some important sectors from the public to the private sectors; in most cases this coincided with a substantial reduction in R&D activities by the new owners.

Between 1980 to 2010, the decline in total government support for R&D was mirrored by a decline in private sector R&D. From R.A.L. Jones, ‘The UK’s Innovation Deficit & How to Repair it’, SPERI paper number 6, 2013.

Where does business R&D take place now, and how is it financed? The broad brush answer is that business R&D is concentrated in a few sectors of the economy, it’s carried out by big businesses, and it’s financed by their own internal cash resources.

In the UK, the dominant sectors are pharmaceuticals, automotive, aerospace, machinery and equipment, precision instruments and optical products, and chemicals. In addition to these manufacturing sectors, there is substantial R&D spending in services, in telecommunications, computer programming and software, and the provision of technical testing and R&D as services in themselves. Of course, these services are often driven by and provided for manufacturing sectors, emphasising the difficulty in a modern economy of making a clean separation between manufacturing and services.

Given the rhetorical emphasis in discussions of innovation on the role of venture capital financed start-ups and highly innovative small businesses, it’s important to understand the relative scale of the contributions of large and small companies. In 2020, total business R&D was reported as £27 billion; of this just £1.5 billion happened in SMEs. Total venture capital investment in 2020, as reported by the BVCA, was £1.7 billion. The Venture Capital sector is itself heavily subsidised by the state, both through direct investments and through tax reliefs.

What kind of R&D does business do? It’s natural to assume that it will be focused on short term improvements of existing products and processes, with any longer term work directed at the introduction of entirely new products, such as new drugs. But one can point to some quite fundamental discoveries made in industrial laboratories in the past.

The most well known example is Bell Laboratories in the USA, which produced the transistor, the UNIX operating system, laser trapping and cooling of atoms, and the discovery of the cosmic microwave background. Other breakthroughs in basic science – of the kind that attract Nobel Prizes – were also associated with other industrial laboratories in the USA, such as General Electric and IBM. Important industrial laboratories in the UK included those run by the chemicals company ICI and the electronics firm GEC.

Neither ICI nor GEC is in existence any more, while in the USA Bell Laboratories is now a much smaller and more business focused operation, owned by Nokia. There are still contributions to basic science from industry owned laboratories – for example Alphabet/Google’s subsidiary DeepMind has made a major contribution to biology through its AlphaFold programme for predicting protein structures. But the perception – backed up by some evidence – is that business R&D has become much more focused on short-term, product focused R&D rather than more basic research. This is understandable given changes to the business landscape over the last few decades.

Bell Labs in its heyday was sustained in effect by the monopoly rents of its parent organisation, the Bell Telephone Company, and when that monopoly was broken up there was naturally less room for expenditure that benefitted wider society without contributing much to the company’s bottom line. The demise of GEC and ICI as major combines at a scale that could justify and finance more speculative research reflects both some individual corporate misjudgements, but also a wider climate of primacy of maximising “shareholder value” in corporate governance.

The side-effect of this, though, is more of a division of labour, with basic research more exclusively the province of universities and research institutes, and industry focusing entirely on shorter-term applied work. I think something has been lost by this separation.

2.3. Is the productivity of the science enterprise slowing down?

If the UK has focused government support on curiosity-driven research, does that mean that its basic research enterprise is in a correspondingly strong state? There are certainly some things to be proud of in the UK’s research base – by measures such as share of highly cited research papers, the UK system seems to deliver internationally competitive results well out of proportion to the money the government puts in. The UK in many ways has worked to optimise its system to deliver “excellence” as defined by the academic community, and the outcome reflects what the country has chosen to optimisea

But that doesn’t mean that everything is fine in the basic research enterprise, in the UK or more widely. There are a number of linked worries, some specific to the UK, some with a wider international relevance. The wider background is a sense that international science is suffering from falling productivity, with diminishing returns in terms of fundamentally new results, from ever increasing investments.

This argument was made in an influential piece by Patrick Collison and Michael Nielsen – Science is getting less bang for its buck, arguing that despite exponential increases in the number of people involved, the amount of money spent, the number of articles published, the rate of production of significant new ideas static or indeed falling. This argument is difficult to quantify – how can one define “significant”? There are linked arguments about whether the rate of innovation more widely defined is slowing (e.g. an influential paper by Bloom, Jones, van Reenan and Webb – Are ideas getting hard to find?) though of course this also calls into question the effectiveness with which basic science is turned into products as well as calling into question the productivity of the basic science enterprise itself. But despite the difficulty of quantifying this, it is worth taking seriously.

There are two quite different views about what might be wrong with basic science, that are at first sight in contradiction, though in my own opinion there are elements of truth in both. One is that a slow-down could reflect too much control over science. Rather than just giving talented scientists resources and freedom to pursue their own priorities, in this view our system has become bogged down with too much bureaucracy and poor incentives. Systems such as peer review have led, in this view, to conservatism and a stultifying consensus which acts to suppress genuinely radical new ideas and approaches.

The other view is that, rather than being over-controlled, academic science has had too much freedom. By drifting apart from the kind of applied science that is subject to the discipline of having to deliver devices and systems that actually work in the world, the argument is that science is in danger of becoming an entirely self-referential system, prone to swings of fashion and producing too much work which is at best poor quality, and at worst irreproducible or just wrong. In this view, most forcibly argued by Dan Sarewitz in his piece Saving Science, it is technology which keeps science honest, and an increasing separation between science and technology is unhealthy for both sides.

These issues are international in their scope – how do they apply to the specific circumstances of the UK’s science system? I’ll discuss the details of the UK’s funding system in the next section of this series of pieces, but there are some consequences of the UK’s structural shift away of government support from departmentally driven applied science to university focused basic science that are worth dwelling on.

I suspect that if you were suggest to most senior academic scientists in the UK that government support has shifted from applied research to more basic science, they would react with disbelief. I believe the more widespread perception is that the shift has been in the other direction – from the perspective of university-based scientists, the pressure has been to demonstrate more practical relevance – more “impact”, in the favoured term of art in UK science policy – of their research.

Broadly speaking, the UK went from a situation in the 1960’s and 1970’s where there was a very large cadre of government supported scientists and technologists doing explicitly applied research, and a relatively smaller group of university-based scientists with more freedom to follow their own research priorities. By the end of the 2000’s, the cadre of explicitly applied scientists was very much smaller, and the university research base was substantially bigger and better resourced. But the continuing rhetorical commitment to science and technology as the driver of economic growth and international competitiveness led to an obvious pressure on the now dominant university-based science to demonstrate its contribution to those goals.

This pressure has had some positive outcomes. It’s good that universities have become more professional about technology transfer and creating spin-outs, that the very positive aspects of collaborations between scientists in industry and academia are more widely recognised, and that the civic universities are rediscovering their mission to support their regional industries and economies.

But the downside is when academic scientists, who are not close enough to the market to understand its real needs, opportunities and constraints, feel compelled to generate unconvincing quasi-commercial motivations for their work. At its worse, the result can be to steer research in directions that are neither fundamentally interesting nor practically relevant.

2.4. The geography of science and innovation

It’s never been easier to access the latest scientific ideas from anywhere with an internet connection, yet the world is not flat. Economic opportunity is highly unequally distributed, with technological innovation concentrated, not just in a few highly developed nations, but in very specific cities and regions within those nations. Information may travel at the speed of light, but know-how moves with people, and the result is that there is a very distinct geography of science and innovation.

The discussions we have about innovation reflect the data we collect, and because we collect data at the level of nation states we think of the nation as the right unit to analyse science and innovation at. But it isn’t obvious that this must be the case.

Instead, we should talk about an “innovation system” – the collection of people and institutions who collaborate, informally or formally, to create ideas, assimilate them from elsewhere, and turn them into value.

These systems can be transnational. Multinational companies represent such a transnational innovation systems, with manufacturing and R&D sites across the world linked by formal management systems and the mobility of people. Beyond the formal limits of a single multinational, there is a penumbra of companies supplying goods and services, and of business customers, all of whom help drive innovation. Think, for example, of the leading semiconductor company TSMC. This sits at the centre of a global network of highly innovative companies. Some are providing inputs to the production process, including the suppliers of highly sophisticated equipment, like the Netherlands’s ASML, and the suppliers of materials of enormous purity. Meanwhile customers such as Apple, working with their designers in ARM, pressure TSMC to innovate to meet their very demanding requirements.

On the other hand, innovation systems can also be subnational in scale, driven by concentrations of institutions and infrastructure, and above all their attractiveness to people with the relevant skills. There are a couple of related concepts here.

One is the old idea, going back to the 19th century economist Alfred Marshall, of “industrial districts” – places where concentrations of related industries cluster. These can have deep historical roots and their evolution is strongly path dependent; close to my home, Sheffield has been a centre of production for steel and steel products since the Middle Ages. In Manchester, an early specialisation in textiles created a demand for chemicals, including fine chemicals like dyestuffs, from which a pharmaceutical industry subsequently emerged.

The other is the more recent phenomenon of science and technology based clusters – in the USA, Boston for biotech, and Silicon Valley for semiconductors and information technology; in Taiwan, Hsinchu for semiconductors and electronics hardware, in the UK, Cambridge for both biotech and ICT.

The success of these examples have led many policy makers around the world to try and create new clusters from scratch, without, it has to be said, universal success. To make a successful cluster, many ingredients have to come together – relevant research institutions, access to finance, strongly expanding markets for the cluster’s products (sometimes, as in the case of the early days of Silicon Valley, driven by very large scale government procurement).

Above all, there needs to be a concentration of appropriately skilled people. This includes high quality scientists, but scientists by themselves are not enough. There need to be high quality managers and financiers, skilled technicians and other intermediate skilled occupations. A successful cluster will have high quality institutions for developing skills at all levels, from research universities to technical colleges. It must also have a vibrant labour market, attracting skilled people from elsewhere, and with people going from job to job taking their know-how with them.

What is the role of research institutions in developing clusters and regions of highly productive technology-led industrial specialisation? I believe that the evidence suggests that a strong and relevant research base is a necessary, but perhaps not sufficient condition, for the success of a cluster. It’s certainly true that both in Boston MA and Cambridge UK those clusters built on a very long history of substantial investment in research in very strong research universities. Meanwhile, the government funded Institute Technology Research Institute was pivotal in getting the Hsinchu, Taiwan cluster established (TSMC was itself a spin-out company from ITRI).

The Hsinchu example shows that the key capability that R&D capacity provides isn’t always the generation of new ideas, but the ability to assimilate and integrate ideas from elsewhere – to provide “absorptive capacity”. The availability of skilled people and the spread of know-how between them is crucial to develop this.

Is there a more general relationship between R&D spending and productivity at a regional level? In the first section of this series, I drew attention to the very pronounced regional productivity disparities in the UK . These differences in regional productivity are mirrored in very substantial differences in regional R&D intensity, as Tom Forth and I detailed in our report “The Missing £4 billion”.

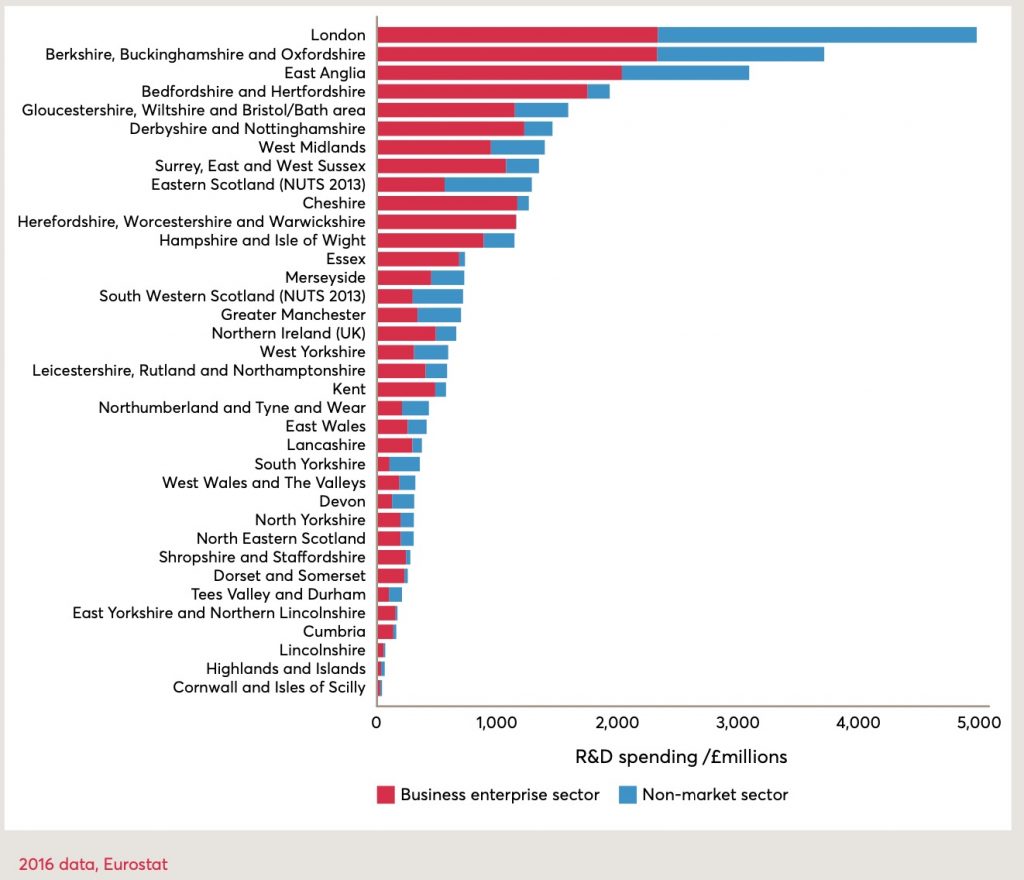

R&D spending in the market and non-market sectors by NUTS 2 region (except London presented at NUTS1 level). From “The Missing £4 billion”.

This plot shows three outliers – London and the two subregions containing Oxford and Cambridge, which between them account for 46 per cent of all public and charitable spending on R&D, but just 31 per cent of business R&D and 21 per cent of the population.

Another nine subregions show respectable levels of total R&D. These include Bristol, Hampshire, Derby, Bedford, Surrey and the West Midlands, Worcestershire and Cheshire. With the exception of East Scotland, all these subregions are characterised by above-average ratios of private to public sector R&D spending. Two subregions stand out for significant private sector R&D and almost no public sector activity – Cheshire, with its historic concentration of chemical and pharmaceutical industries, and Warwickshire, Herefordshire and Worcestershire. Then there is a long tail with much lower public and private investment in R&D, including all of Wales, Northern Ireland, the North of England, Lincolnshire, South West England beyond Bristol, and Kent and Essex in the South East.

This regional imbalance in R&D spending mirrors the regional disparities in economic productivity. The most prosperous and productive parts of the country – broadly, Greater Southeast England, comprising London, the Southeast, and parts of the East of England – have the greatest concentrations of R&D investment, while less productive regions in the North and Midlands, and in Wales and Northern Ireland, have substantially less investment in R&D. Curiously, the imbalance is greater for public sector R&D than in the private sector.

If investments in research and development do contribute to productivity growth, and the beneficial effect of those investments is at least in part geographically bounded, then the spatial aspects of the UK government’s R&D policies have been acting as an anti-regional policy for some decades.

To come next: part 3 – The institutional evolution of the UK’s research & innovation system.

First, I am here via a Cummings tweet. Second, thanks for an interesting read. Finally, you don’t talk about current things like Arm, a UK success being sold off (oh or not, or may be) and in mf field, what is Dyson up to? These are examples of innovation IMHO that need help to contribute to the UK economy. I suspect that if we were in the states, Arm would be given a big and continuing contract series with BAE Systems. Dyson, similarly, would have “military advisors” working with his robot people, ostensively on vaguely military use-cases, but in reality just to stop them tinkering and get them address the issues that will matter to venture capital in 5 years time.